Cryptocurrency can feel like a maze when you’re first starting out. With so many coins and tokens out there, it’s hard to know where to begin. One name you might have come across is XRP.

So, what is XRP? It’s a type of digital currency created to make sending money across borders faster and cheaper. While Bitcoin is often seen as digital gold, XRP was built with payments in mind.

In 2025, XRP continues to play a big role in the crypto space. It’s used by individuals and businesses alike—and it’s built to move value quickly and with low fees. Whether you’re just curious or ready to dive in, this guide will help you understand what XRP is and why it matters.

Key Takeaways

- XRP is a cryptocurrency built for fast, low-cost payments. It runs on its own blockchain called the XRP Ledger.

- It was created by Ripple Labs to improve cross-border money transfers. XRP is designed to move value quickly between parties, even across borders.

- XRP uses a consensus mechanism instead of mining. This allows it to confirm transactions in seconds, using far less energy than Bitcoin.

- In 2025, XRP continues to be used by individuals and institutions. Its speed and efficiency make it popular for financial applications.

What Is XRP?

XRP is a type of digital money known as a cryptocurrency. It was created by Ripple Labs in 2012 to make sending money faster and cheaper.

Unlike Bitcoin, XRP doesn’t rely on mining. Instead, it uses a special kind of agreement between trusted computers called a consensus mechanism.

XRP runs on its own blockchain network called the XRP Ledger. This network was built from the ground up to handle payments, not just store value.

A Brief History of XRP

Ripple was founded in 2012 by a team of developers, including Jed McCaleb and Chris Larsen. Their mission was simple: fix the outdated, slow banking system used for global payments.

They introduced XRP as a solution. It would act as a bridge currency between different financial systems, allowing money to move instantly.

Over the years, Ripple has partnered with major banks and payment providers. These partnerships helped XRP gain attention in the finance world.

How XRP Works

XRP doesn’t use traditional mining like Bitcoin. Instead, it relies on a group of trusted validators who agree on which transactions are valid.

This system is faster and more energy-efficient. Transactions usually settle in 3 to 5 seconds.

Key facts about how XRP works:

- Uses a consensus algorithm (not proof-of-work or proof-of-stake)

- No mining required

- Cannot be staked to earn rewards

- Maximum supply of 100 billion XRP tokens

- Transactions cost just a fraction of a cent

Because XRP does not use proof-of-work or proof-of-stake, you can’t mine it or stake it. If you’re curious how those two systems work, check out our Proof of Work vs. Proof of Stake guide.

The XRP Ledger is also open-source. Anyone can build on it or use it to send value.

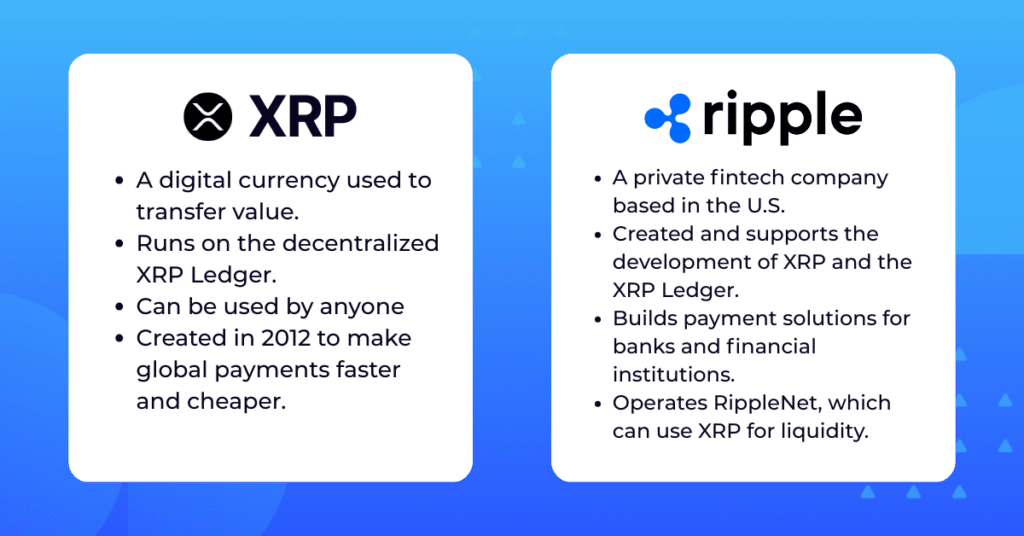

Ripple vs XRP: What’s the Difference?

It’s common to hear the words “Ripple” and “XRP” used together, but they’re not the same.

- Ripple is the company that created XRP and helps develop the XRP Ledger.

- XRP is the digital currency that moves through the XRP Ledger.

Ripple also built RippleNet, a network of financial institutions using Ripple’s tech to move money. Some of these systems use XRP for liquidity.

In recent years, XRP’s legal status has also made headlines. A major case with the U.S. Securities and Exchange Commission (SEC) led to increased clarity. As of 2025, XRP is allowed to be traded in the U.S. again.

XRP’s Legal Case with the SEC

In 2020, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs. The SEC claimed that XRP was an unregistered security, according to the SEC website.

This caused major uncertainty for XRP in the U.S. Many exchanges temporarily stopped offering XRP during the case.

After years of legal battles, a final decision was reached in 2025. The court ruled that XRP is not a security, and it can now be legally traded in the U.S. again, according to CoinTelegraph.

This decision provided much-needed clarity and helped restore confidence in XRP for both investors and financial institutions.

XRP Use Cases in 2025

XRP is more than just a digital coin. It’s used in real-world financial systems.

Here’s how people and companies use XRP in 2025:

Fast International Payments

XRP enables money to move across borders in just seconds. It’s especially useful for people and companies sending funds between countries.

Providing Liquidity for Banks and Exchanges

Banks and crypto exchanges can use XRP to quickly exchange one currency for another. This helps them avoid the delays and costs of traditional banking systems.

Moving Value Between Digital Tokens and Fiat Money

XRP acts as a bridge between cryptocurrencies and traditional currencies like the U.S. dollar. This makes it easier to trade or transfer value across different financial systems.

Experimenting with Central Bank Digital Currencies (CBDCs)

Some countries are exploring how XRP’s technology could support their own digital currencies. It may help central banks move funds faster and more securely.

Because of its low fees and quick speed, XRP is especially useful for sending money across borders.

XRP vs Bitcoin

|

Feature |

XRP |

Bitcoin |

|---|---|---|

|

Speed |

Seconds |

Around 10 minutes |

|

Fees |

Fraction of a cent |

Can vary, often higher |

|

Energy Use |

Low, uses a consensus protocol |

High, uses Proof of Work |

|

Purpose |

Built for fast payments |

Seen as a store of value |

XRP and Bitcoin are both cryptocurrencies, but they serve different purposes.

Here’s a quick comparison:

- Speed: XRP takes seconds. Bitcoin takes about 10 minutes.

- Fees: XRP transactions cost a fraction of a cent. Bitcoin fees vary and are often higher.

- Energy use: XRP’s consensus method uses far less energy than Bitcoin’s proof-of-work mining.

- Purpose: XRP was built for payments. Bitcoin is mostly seen as a store of value.

Each has its strengths, but XRP stands out for quick, low-cost money movement.

How to Buy XRP

You can buy XRP online using your favorite payment method. RockItCoin gives you two easy ways to get started.

Buy XRP on the RockItCoin Website

- Go to the RockItCoin website.

- Click on “Buy With Card.”

- Choose XRP and enter how much you’d like to buy.

- Complete your purchase with your credit card, debit card, Apple Pay, Google Pay, PayPal, or Venmo balance.

Buy XRP in the RockItCoin App

- Download the RockItCoin app from the App Store or Google Play.

- Create an account and complete verification.

- Tap “Buy Crypto” and select XRP.

- Enter your payment details and confirm your purchase.

Both methods are beginner-friendly and take just a few minutes. Once your purchase is complete, you can store your XRP in the RockItCoin app.

How to Store XRP Safely

When you own crypto like XRP, you need a digital wallet to keep it safe.

There are two main types:

- Hot wallets are connected to the internet and are easy to use.

- Cold wallets are offline and offer extra security.

The RockItCoin app acts as a secure hot wallet. It gives you full control of your XRP with private key access.

Here are a few storage tips:

- Always back up your wallet info.

- Use strong passwords and enable two-factor authentication.

- Never share your private keys with anyone.

Is XRP a Good Investment?

We won’t tell you what to buy, but we can help you understand the big picture. Like any cryptocurrency, XRP has its pros and cons. Knowing both can help you make smarter decisions.

XRP has benefits:

- Fast, cheap, and energy-efficient

- Used by companies and institutions

- Gaining legal clarity in the U.S.

These strengths make it attractive for payments and cross-border transactions. Its low fees and transaction times set it apart from many other cryptocurrencies.

It also has risks:

- Crypto prices are volatile

- Regulatory landscapes can change

XRP has faced legal battles in the past, and while much has been resolved, future regulations could still impact its use. And like all crypto assets, its price can rise and fall quickly.

Do your own research before investing. XRP might be a good fit for some, but it’s important to stay informed.

Final Thoughts on XRP

XRP continues to play a unique role in crypto. It was built to move money quickly, and it’s still doing just that.

Whether you’re a beginner or looking to expand your crypto knowledge, XRP is a key name to know. Learning about XRP is a great way to explore how cryptocurrency is changing the world of payments.

If you’re ready to take the next step, getting started is simple:

- Download the RockItCoin app to buy and store XRP

- Visit the Buy With Card page on our website to make your first purchase

- Explore more crypto guides and tips on RockItCoin’s blog!