Decentralized Finance (DeFi) is revolutionizing how we interact with money, offering financial services without relying on traditional intermediaries like banks or brokers. Built on blockchain technology, DeFi enables peer-to-peer transactions, giving users unprecedented control and flexibility over their financial activities. From lending and borrowing to trading and earning interest, DeFi is reshaping the global financial landscape.

Key Takeaways

- DeFi simplifies financial transactions by removing intermediaries and reducing costs.

- Blockchain powers DeFi through transparent and secure ledgers.

- DeFi opens financial access to anyone with internet connectivity.

What Is DeFi?

DeFi, short for Decentralized Finance, refers to a new financial system built on blockchain technology. Unlike traditional finance, where banks and other institutions control transactions, DeFi operates on peer-to-peer networks, eliminating the need for intermediaries. Through the use of smart contracts—self-executing agreements coded on the blockchain—DeFi enables secure, transparent, and efficient financial services.

In traditional finance, opening a bank account, taking out a loan, or making investments requires approval from central authorities. DeFi disrupts this model by allowing anyone with an internet connection to access similar services through decentralized apps (dApps). These dApps function on public blockchains (primarily Ethereum) and support a wide range of financial activities.

How Does DeFi Work?

DeFi leverages blockchain technology to provide financial services directly to users. Here’s how it works:

Blockchain Technology

At the core of DeFi is blockchain—a distributed ledger that records transactions securely and transparently. Each transaction is grouped into “blocks” and linked to previous ones, forming an unchanging chain. Ethereum is the most popular blockchain for DeFi applications, but other platforms like Binance Smart Chain and Solana are gaining traction.

Smart Contracts

Smart contracts are self-executing agreements written in code and stored on the blockchain. They automatically enforce the terms of an agreement when predefined conditions are met. For example, a smart contract can release funds only after a borrower repays a loan.

Decentralized Applications (dApps)

Users interact with DeFi through dApps, which provide interfaces for lending, borrowing, trading, and other financial activities. Unlike traditional banking apps, dApps are open-source and operate without central control, offering users greater transparency and control over their assets.

DeFi vs. Traditional Finance

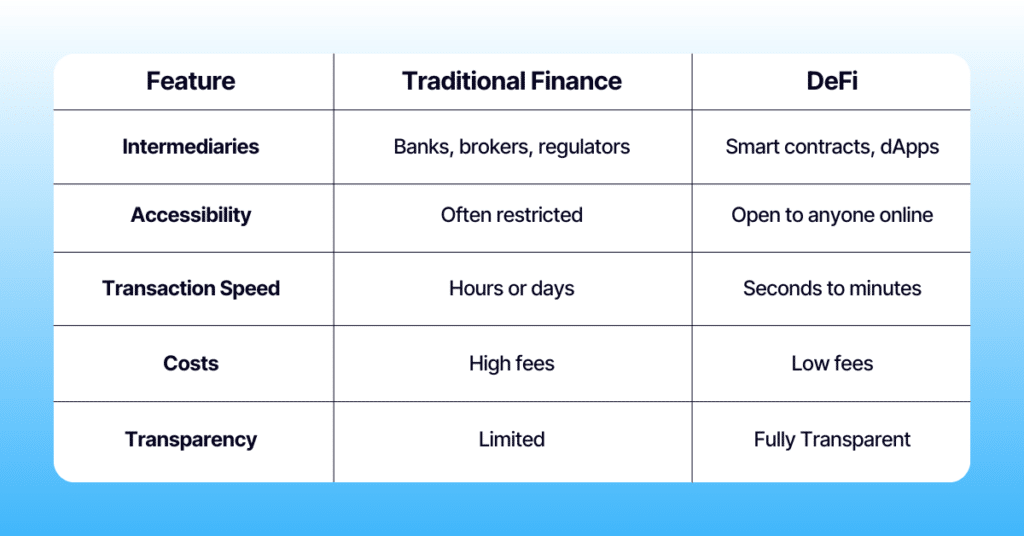

Intermediaries

Traditional finance relies on banks, brokers, and regulators to process transactions. DeFi removes these middlemen by using smart contracts and decentralized applications (dApps) to automate financial processes.

Accessibility

Traditional finance often excludes individuals without access to banking infrastructure. DeFi bridges this gap by allowing anyone with an internet connection to participate, regardless of location or credit history.

Transaction Speed

In traditional systems, transactions can take hours or even days to settle. DeFi platforms, on the other hand, complete transactions in seconds or minutes, providing near-instantaneous processing.

Costs

Traditional financial services often charge high fees for transactions, loans, and currency exchanges. DeFi significantly lowers these costs by eliminating intermediaries and streamlining processes.

Transparency

Traditional finance operates with limited transparency, often requiring trust in institutions. DeFi, built on blockchain technology, offers full transparency, with all transactions publicly recorded on an immutable ledger.

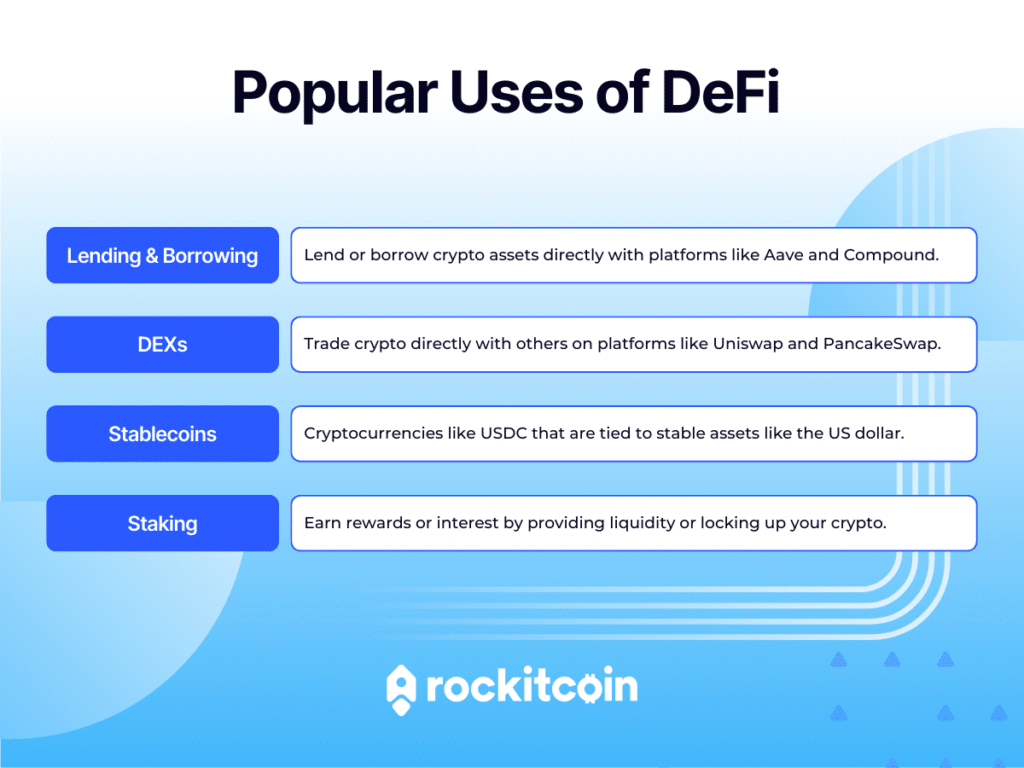

Popular Uses of DeFi

DeFi offers a broad range of financial services, often mirroring those found in traditional finance but with added benefits:

Lending and Borrowing

Platforms like Aave and Compound enable users to lend their crypto assets to others in exchange for interest. Borrowers provide collateral, ensuring secure transactions.

Decentralized Exchanges (DEXs)

DEXs like Uniswap and PancakeSwap allow users to trade cryptocurrencies directly without relying on centralized exchanges. These platforms offer increased privacy and control over funds.

Stablecoins

Stablecoins, such as USDC and DAI, are cryptocurrencies pegged to stable assets like the US dollar. They provide a reliable medium of exchange in the volatile crypto market.

Yield Farming and Staking

Yield farming involves earning rewards by providing liquidity to DeFi platforms, while staking allows users to lock up their crypto to support blockchain operations and earn returns.

Learn more about staking crypto

Bitcoin and DeFi

Bitcoin, the first-ever cryptocurrency, created the foundation for decentralized finance by showcasing the potential of blockchain technology. While Bitcoin mainly serves as a digital store of value and medium of exchange, its underlying principles have significantly influenced the evolution of DeFi applications, especially on platforms like Ethereum.

How Bitcoin Relates to DeFi

- Limited Functionality: Bitcoin’s blockchain supports secure and immutable transactions but lacks the flexibility and programmability of blockchains like Ethereum, which are tailored for DeFi through smart contracts.

- Store of Value: Within DeFi, Bitcoin often functions as collateral for loans or a tradable asset on decentralized exchanges.

- Bridging Solutions: Technologies like Wrapped Bitcoin (WBTC) enable Bitcoin to interact with DeFi platforms by converting it into a tokenized form compatible with Ethereum.

Bitcoin’s Role in DeFi’s Growth

Bitcoin’s success validated the viability of blockchain as a secure and decentralized technology, paving the way for innovative use cases like lending, trading, and yield farming in the DeFi space. As cross-chain solutions continue to advance, Bitcoin’s role in the DeFi ecosystem could expand further.

Benefits of DeFi

Financial Inclusion

DeFi democratizes access to financial services, enabling the unbanked and underbanked populations to participate in the global economy.

Transparency

All transactions on DeFi platforms are recorded on the blockchain, ensuring a transparent and verifiable ledger.

Cost Efficiency

By eliminating intermediaries, DeFi reduces fees for transactions, lending, and other financial activities.

Innovation

DeFi platforms introduce new financial instruments, such as flash loans—instant loans without collateral that are settled in a single transaction.

Risks and Challenges

While DeFi offers numerous advantages, it’s essential to understand the risks:

Security Vulnerabilities

Smart contracts can have coding flaws that hackers may exploit. Always research platforms and prioritize those with audited contracts.

Market Volatility

The crypto market’s inherent volatility can impact DeFi investments and earnings significantly.

Complexity

Navigating DeFi platforms can be overwhelming for beginners. Take time to learn and start with smaller investments.

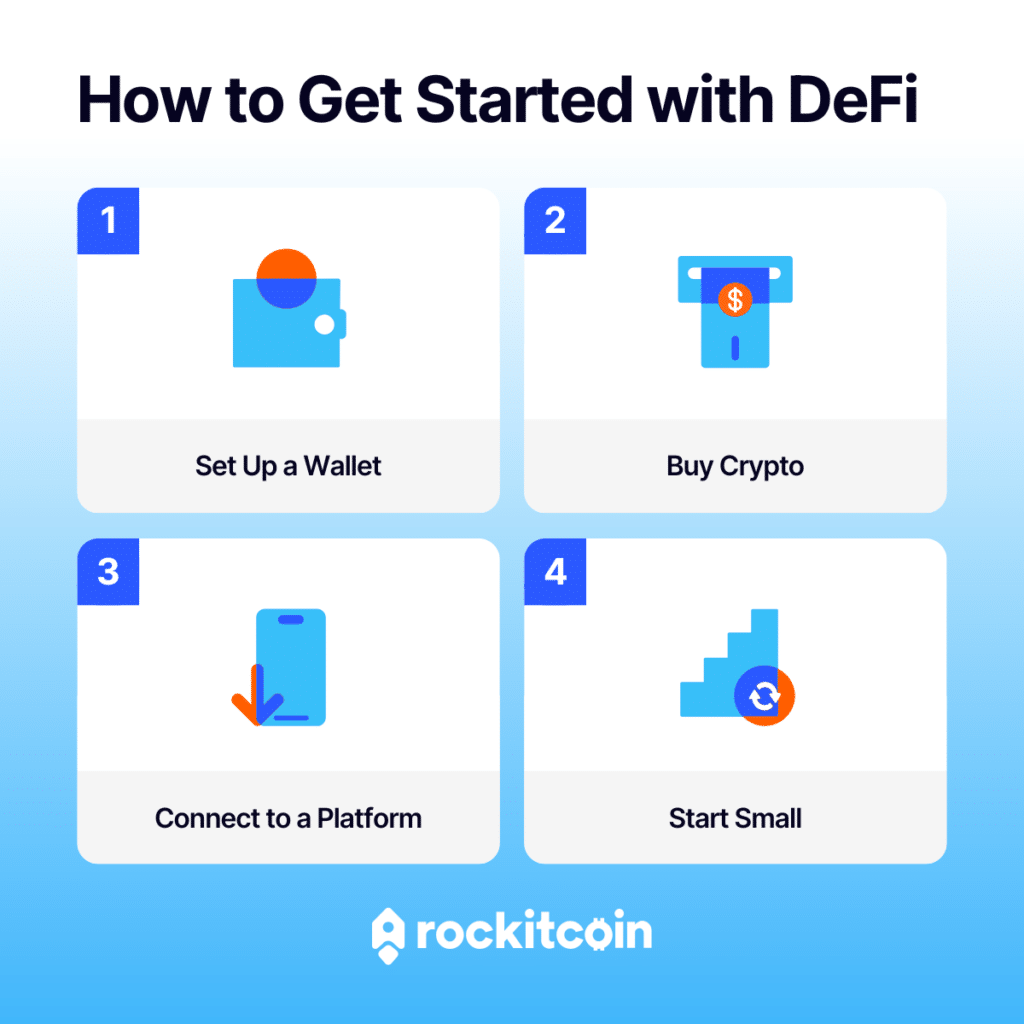

How to Get Started with DeFi

Getting started with DeFi is simple if you follow these steps:

- Set Up a Wallet: Choose a secure digital wallet like MetaMask or Trust Wallet to store your crypto assets. RockItCoin’s app offers a user-friendly wallet perfect for beginners.

- Buy Cryptocurrency: Use a trusted exchange to purchase crypto, such as Ethereum. RockItCoin ATMs and app make purchasing cryptocurrency convenient and secure.

- Connect to a DeFi Platform: Link your wallet to a platform like Uniswap or PancakeSwap.

- Start Small: Experiment with lending, borrowing, or staking to gain experience. RockItCoin’s blog is designed to support your journey as you explore DeFi.

The Future of DeFi

DeFi’s potential is immense, with ongoing innovations such as:

- Cross-Chain Interoperability: Seamless transactions across multiple blockchains.

- Real-World Asset Tokenization: Tokenizing assets like real estate and stocks for decentralized trading.

- Decentralized Identity Solutions: Secure, trustless identity verification systems.

As DeFi evolves, it could redefine global finance, making it more inclusive, efficient, and innovative.

Get Started with DeFi and RockItCoin

Ready to explore the world of DeFi? RockItCoin provides the tools you need to get started. Whether you’re looking to purchase cryptocurrency through our ATMs or use our app to buy and manage crypto, we make the process simple and secure.

Why Choose RockItCoin?

- Ease of Use: Beginner-friendly tools to help you navigate DeFi.

- Security: Trusted by thousands for secure transactions.

- Accessibility: Thousands of ATMs nationwide and an easy-to-use mobile app.

Visit our website or download the RockItCoin app today to take your first step into decentralized finance.

Conclusion

DeFi is reshaping the way finance works by providing accessible, transparent, and innovative alternatives to traditional banking systems. By utilizing blockchain technology, DeFi puts individuals in control of their financial decisions and activities. The opportunities within DeFi are vast, but it’s important to be aware of the risks and approach with caution. With services like those offered by RockItCoin, getting started with decentralized finance has never been easier.

Frequently Asked Questions

What is DeFi in simple terms?

DeFi refers to financial services that operate on blockchain technology, enabling peer-to-peer transactions without intermediaries like banks.

How does DeFi differ from Bitcoin?

Bitcoin is a cryptocurrency, while DeFi encompasses a broader range of financial services, such as lending, trading, and earning interest, built on blockchain platforms.

Is DeFi safe?

DeFi offers security through blockchain technology, but risks like smart contract vulnerabilities and scams exist. Research and caution are essential.

What are the top DeFi platforms?

Popular platforms include Aave for lending, Uniswap for trading, and Yearn Finance for yield farming.

How can I earn passive income with DeFi?

You can earn passive income through activities like staking, yield farming, or lending on DeFi platforms.

This blog is for informational purposes only and should not be considered financial, legal, or investment advice. Always do your own research and consult with a qualified professional before making any financial decisions. RockItCoin does not guarantee the accuracy or completeness of the information provided and is not responsible for any losses or damages incurred as a result of using this information.