Hillary Clinton recently framed cryptocurrencies as a national security threat. She argued that nation-states, independent actors, or both could use crypto as a means of “destabilizing countries, destabilizing the dollar as the reserve currency.” But how would that work exactly?

To answer that question, let’s turn for a moment to talk about Jason Lowery, a guardian in the US Space Force. Lowery is studying Bitcoin as a National Defense Fellow at the Massachusetts Institute of Technology and has some very interesting views on it.

The Safety of Bitcoin

While most people fault Bitcoin for its energy consumption, Lowery sees it as one of Bitcoin’s greatest strengths. Bitcoin is a Proof-of-Work consensus protocol, meaning that Bitcoin miners confirm transactions on the network by solving complicated cryptographic equations. The powerful computers that do so require an immense amount of electricity.

By requiring such large amounts of energy to confirm transactions, the Bitcoin network is virtually impossible to compromise. Doing so would require a nefarious actor to control 51% of all of the mining on the network. This would allow them to spend the same coins multiple times, which would likely cause the price of the coin to crash as users lose confidence in its security.

The Danger of 51% Attacks

Imagine buying a car with cash. Then, as you’re driving away from the dealership, the cash jumps out of the safe at the dealership and ends up back into your pocket, ready to be spent again. If any group succeeds in a 51% attack of any cryptocurrency network, that’s the power they would gain. And, understandably, that would completely destabilize that network’s value.

This possibility must be what Clinton has in mind when posing crypto as a potential national security threat. If a 51% attack successfully occurs today, it would be troubling. But with crypto’s market cap amounting to “just” 2.2 trillion dollars, governments won’t crumble even if all crypto disappeared overnight.

However, as crypto use cases continue to grow and adoption becomes more mainstream, a 51% attack could be detrimental. If any cryptocurrency becomes integral to any country’s infrastructure, nefarious actors who take control of the network could effectively destroy that infrastructure.

Bitcoin’s Energy Use Provides Security

To Lowery’s point, the energy needed to mine Bitcoin, coupled with the competition among miners, makes it incredibly unlikely that any group will be able to gain control of the network. The more energy mining takes, the safer the network. And because Bitcoin requires the most energy to mine, it’s also the safest cryptocurrency in terms of its defense against a 51% attack.

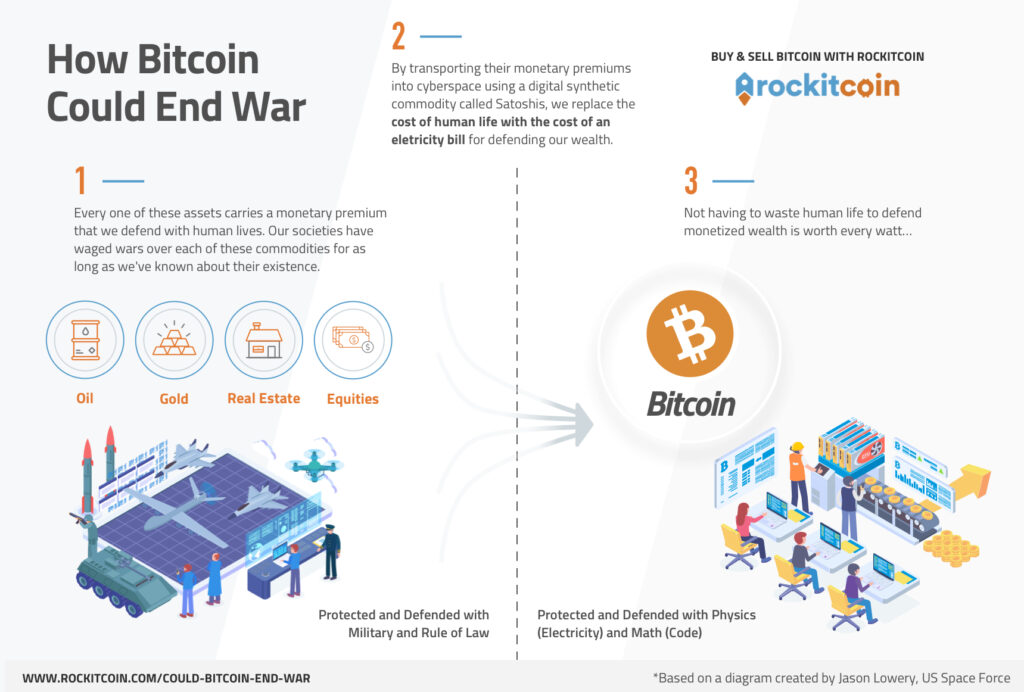

Understanding Bitcoin’s unique security, Lowery takes a step back from the common view of the coin as a store of value to suggest that it could be used for other purposes. Namely, he suggests that Bitcoin could replace nuclear weapons and their promise of mutually assured destruction.

War, What Is It Good For?

Lowery sees direct parallels between miners confirming transactions through their use of energy and militaries confirming property rights through war and threats of war. On his LinkedIn page, he explains,

War is the globally adopted Proof-of-Work social consensus protocol that nodes (countries) use to validate the legitimate state of property and its chain of custody. Militaries project force across time (i.e energy) in a fundamental game of probability to trigger a capitulation event. This is functionally identical to Bitcoin PoW miners projecting energy to probabilistically trigger the end of each block.

Thus, if we can agree to record property rights on the Bitcoin network, it may be possible to make war obsolete. Rather than militaries exerting or threatening to exert their energy (bullets, bombs, etc) to defend or change a given property right (i.e. international borders), miners could defend those rights. As a result, arms races would be replaced by energy races.

Instead of buying more bombs and guns to defend property rights, militaries would invest in Bitcoin mining hardware to defend against 51% attacks. The incentive to develop nuclear weapons for protection would become an incentive to develop inexpensive electricity and electronics.

Ford & Tesla Agree

Almost 100 years ago to the day, Henry Ford suggested that replacing gold with an energy-based currency could end all wars. Twenty-some years earlier, Nikola Tesla came to a similar conclusion, stating that “the main object” of “the war apparatus will be” to achieve “the greatest possible speed and maximum rate of energy-delivery…. When this happy condition is realized, peace will be assured.”

Bitcoin is this energy-based currency. Although it’s still in its infancy, Bitcoin has the potential to end war. However, that would require a global agreement to record and uphold property rights via the Bitcoin network.

If Energy-Based Currency Could End War, Why Hasn’t It?

Ford argued that bankers are the biggest obstacle to ending war via an energy-based currency. The current “consensus protocol,” war, benefits bankers greatly. As Ford put it,

With… international bankers[,] the fostering, starting[,] and fighting of a war is nothing more nor less than creating an active market for money…. No matter who loses the war[,] there have been a great many loans.

Traditional financial institutions are notoriously averse to change because of its inherent risks and the difficulty of quantifying those risks in financial models. In the early days of Bitcoin, several banks and credit card companies went so far as to block all crypto transactions.

But banks preventing their products (credit cards) from being used to help a competing product (Bitcoin) gain marketshare is far different than resisting world peace for motives of personal profits. And despite the early efforts to discourage Bitcoin adoption, the coin continues to attract more users and gain value.

So perhaps the reason that an energy-based currency has yet to end war is simply that Bitcoin is the first to gain real popularity. Perhaps it just required a leap of faith à la Field of Dreams; “If you build it, wars are done.” The currency needed to be created and gain traction on its own merits, because who would ever believe that “internet money” could end war? And now that Bitcoin does exist, it will be fascinating to see whether Ford, Tesla, and Lowery are right.

Bullish on Bitcoin Yet?

Thinking about Bitcoin in this kind of abstract way is incredibly exciting. Whether or not it ever ends war is beside the point. What’s exciting is that the world has only scratched the surface of what Bitcoin and blockchain technology can do. There’s one thing Bitcoin has consistently proven to do: make money for those who hold it.

So whether you’re on a mission for world peace or just profit, filling your wallet with Bitcoin seems like a good idea, doesn’t it? You can buy Bitcoin with a credit card right here on our site. Or if you prefer to buy crypto with cash, you can do so at any of our 1,500+ Bitcoin locations.